One of the first questions I ask people is, “What’s your marketing budget?” It’s not just small talk – this question unlocks doors of opportunity and grounds goals in reality. Surprisingly, most of the time, people don’t have a clue what their budget should be, whether they’re running a marketing budget for a tech startup or managing finances for an established corporation.

That’s why I wrote this post. Consider it your definitive guide to determining your marketing budget, based on various factors and models. Because, like most things in life, there’s no one-size-fits-all answer or universal marketing budget template. But I promise you, one of these approaches will be the right fit for your situation, whether you’re crafting a marketing budget for a small business or a multinational company.

Let’s address the elephant in the room: you can’t squeeze blood from a rock. It’s a common saying, but it’s painfully true in marketing. If you’re expecting your sales and marketing to grow by leaps and bounds while drastically underfunding it, you’re in for a rude awakening. This mismatch is the number one reason I see people falling short of their goals. It’s not about wrong strategies, misguided tactics, or assembling the wrong team – it’s simply that they’ve underfunded their ability to grow and be competitive.

When we crunch the marketing math, we often find companies are underfunding what’s appropriate for their industry and growth goals. And while that’s their prerogative, it’s crucial to be realistic. All progress starts by telling the truth. Understanding what’s needed to fuel your desired growth gives you the opportunity to decide if you’re willing to commit those resources.

And here’s the silver lining: if you don’t have the resources, this realization allows you to set appropriate goals that you can actually hit. It’s a reality check, sure, but one that sets you up for success rather than frustration.

“Nothing ventured, nothing gained”

Remember, there’s no profit without risk. “Nothing ventured, nothing gained,” as the saying goes. This post is the first step in a series to help you reach the growth levels you’re after. By the end, you’ll be able to draft a marketing budget that you feel good about – one that’s grounded in data and tailored to your situation.

Models

Determining your marketing budget isn’t one-size-fits-all. We’ll explore four methods: LTV, Goal based, Top Line Revenue, and Gross Profit. Each has pros and cons, so let’s find the best fit for your business.

LTV Method: The Gold Standard

One of the most established methods for determining your marketing budget is the Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio. This approach focuses on the total value you can expect from a new customer over their entire relationship with your business.

For a product-based business, LTV includes all future repurchases. For a SaaS company, it factors in the average customer tenure and monthly cost. The golden rule here is simple: you should spend about a third of a customer’s lifetime value on acquiring them. This 3:1 ratio (LTV:CAC) is designed to create a sustainable business model.

Here’s the basic idea: If a customer is worth $300 to your business over their lifetime, you should be willing to spend up to $100 to acquire them. Sounds straightforward, right? Well, not so fast.

Challenges with the LTV Method

- LTV Uncertainty: In my experience, most companies don’t actually know their true LTV. It requires substantial financial expertise and years of data to calculate accurately.

- Time and Data Requirements: For instance, if your typical customer lifecycle is six years, you’d need six years’ worth of data to determine your LTV confidently. That’s a long time to wait for crucial information.

- Cash Flow Constraints: Even if you know your LTV, you might not have the cash flow to support spending a third upfront and waiting months or years to recoup the other two-thirds. Remember, that’s where all your profit is!

When to Use the LTV Method

If you’re one of the few businesses that knows your LTV with certainty and has the cash flow to support this approach, it’s considered the gold standard.

Here’s how to apply it:

- Determine your LTV goal for the year.

- Calculate one-third of that goal as your marketing budget.

Let’s break this down with a hypothetical example

Say your LTV per customer is $10,000, and you want to generate an additional $1 million in LTV revenue. Here’s how the math works out:

- Number of new customers needed: $1,000,000 ÷ $10,000 = 100 customers

- Marketing budget: $1,000,000 ÷ 3 ≈ $333,000

So, to generate $1 million in additional LTV revenue, you’d need to acquire 100 new customers and should allocate about $333,000 to your marketing budget.

My Take: The LTV method is a powerful tool when you have the data and cash flow to support it. It creates a sustainable model that aligns your marketing spend with long-term customer value. However, it’s crucial to have accurate data and strong financial footing to make it work effectively.

The Upside: For businesses with a clear understanding of their LTV and robust financials, this method provides a reliable framework for budget allocation that ensures profitability and sustainable growth.

Bottom Line: If you know your LTV with certainty and have the cash flow to support this approach, it’s an excellent method that can drive long-term success. However, for many businesses, LTV uncertainty and cash flow limitations make this approach challenging to implement effectively. If that’s your situation, don’t worry – we’ve got other methods coming up that might be a better fit.

LTV Method Calculator

Note: This calculator uses the 3:1 LTV:CAC ratio, allocating one-third of the LTV to marketing. Ensure you have accurate LTV data and consider your cash flow before applying this method.

Goals Method: Ambition Meets Reality

The goal-based method for determining your marketing budget is a popular approach that starts with your growth objectives. It’s straightforward in theory but comes with some significant caveats that are important to consider.

Here’s how it works: First, you determine your desired revenue growth. Then, based on analyzing past performance, you determine what percentage of this growth goal you’ll need to allocate to marketing to hit the target. Finally, you calculate your budget based on that percentage.

For example, let’s say you’re aiming for $1 million in additional revenue this year. After analyzing past performance, you know that you’ll need to spend roughly 20% of this growth goal on marketing efforts. In this case, your marketing budget would be $200,000 (20% of $1 million).

This method can be appealing because it directly ties your marketing spending to your growth goals. It gives you a clear target to aim for and can help justify marketing expenditures to stakeholders. However, it’s not without its challenges.

Challenges with the Goals Method

1. Data Integrity: This approach relies heavily on accurate data and closed-loop reporting. According to recent research, less than 50% of companies have this level of reporting in place. Without solid data, you’re essentially making educated guesses.

2. Resource Constraints: This method encourages setting ambitious goals without necessarily considering the resources available. You might end up with lofty targets that you can’t realistically fund.

My Take: While helpful for companies with strong analytics, this method often starts from the wrong point. Your budget should inform your goals, not vice versa. Balance ambition with available resources.

The Upside: For companies with robust data, this method provides an easy-to-explain framework for aligning marketing budgets with growth targets, useful for securing stakeholder buy-in.

Bottom Line: Use this method if you have high confidence in your data and marketing-to-revenue relationship. Be prepared to adjust goals if they exceed available resources. For companies without strong analytics, consider other methods to avoid unrealistic expectations.

Goals Method Calculator

Marketing Budget: $200,000

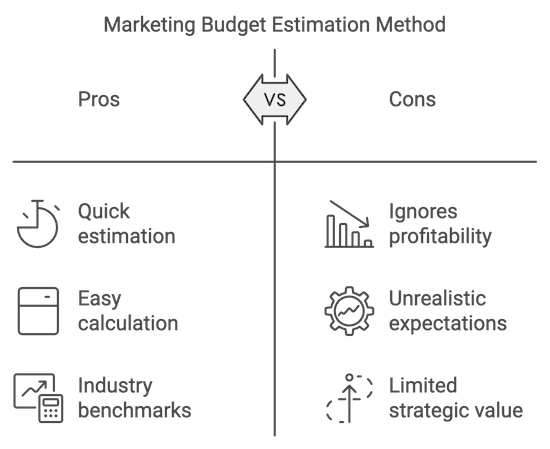

Top Line Revenue Method: Popular but Potentially Flawed

The top-line revenue method is arguably the most popular approach to determining marketing budgets. Its simplicity and the abundance of benchmark data make it an attractive option for many businesses.

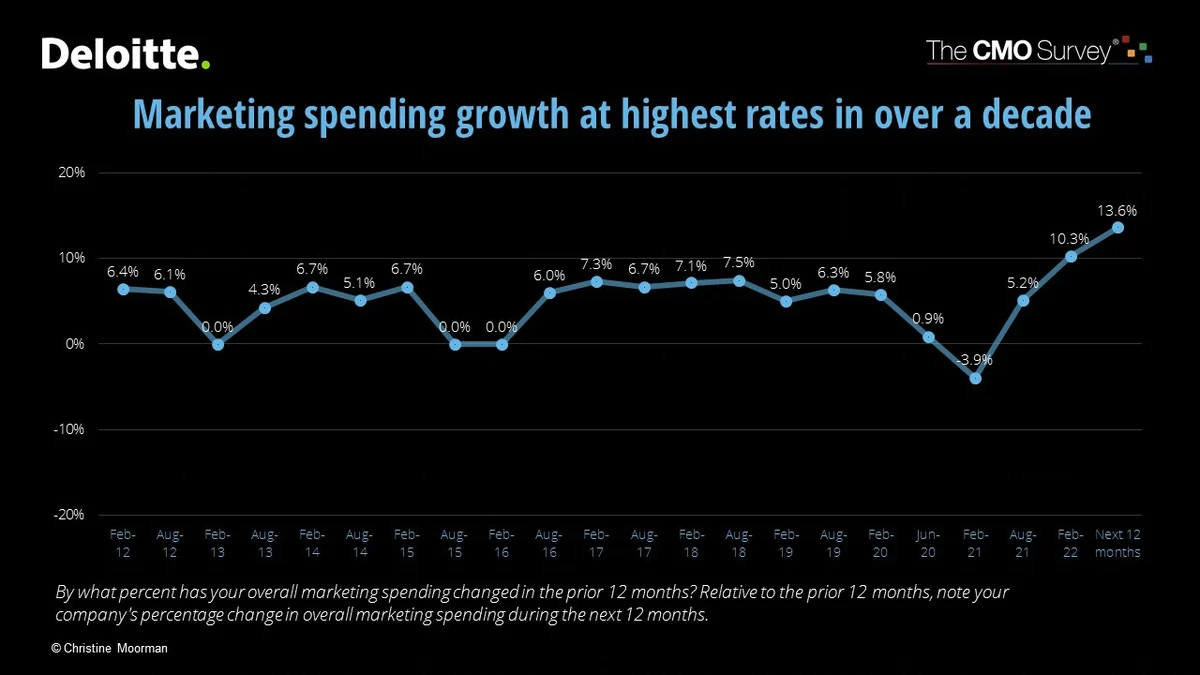

Here’s how it works: You allocate a percentage of your total revenue to marketing. According to Gartner’s CMO Spend and Strategy Survey, the average marketing budget in 2023 was 9.1% of total revenue. This percentage has remained relatively consistent over the past few years.

For example, if your company’s annual revenue is $10 million, using this method, you would allocate about $910,000 to marketing (9.1% of $10 million).

While straightforward, this method has some significant drawbacks that are important to consider.

Challenges with the Top-Line Revenue Method

1. Ignores Profitability: This approach doesn’t account for different business models and their varying profitability levels. A company with high revenue but low margins might allocate too much to marketing using this method.

2. Oversimplification: It assumes a one-size-fits-all approach, which may not be appropriate for all industries or business stages.

3. Misaligned Incentives: By focusing solely on revenue, it may encourage pursuing sales growth at the expense of profitability.Regardless of what medium is used to report on KPIs, its best to follow these best practice.

My Take: While popular and easy to calculate, this method overlooks a crucial factor: profitability. The purpose of a business isn’t just to increase sales, but to generate profit. Your budget calculations should factor in your profitability targets.

The Upside: This method provides a quick and easy way to estimate marketing budgets, with plenty of industry benchmark data available for comparison.

Bottom Line: Use this method for initial estimations or industry comparisons, but be aware of its limitations. For a more accurate and strategic approach, consider methods that factor in profitability, such as the Gross Profit method we’ll discuss next.

Top Line Revenue Method Calculator

Marketing Budget: $91,000

Note: The average marketing budget is 9.1% of total revenue, according to Gartner’s CMO Spend and Strategy Survey.

However, marketing spend can vary significantly by industry. Refer to the industry-specific benchmarks provided below this calculator for more accurate comparisons based on your sector.

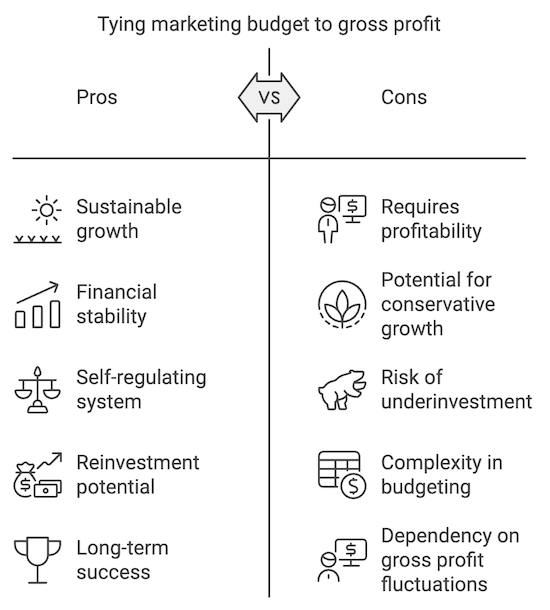

Gross Profit Method: Sustainable Growth Focus

The Gross Profit method is my favorite approach to determining marketing budgets because it emphasizes profitability and sustainability. This method aligns your marketing spend with your actual financial capacity to invest in growth.

Here’s how it works: Calculate your gross profit (revenue minus the cost of goods sold) and reinvest 10% to 30% of this amount into marketing.

For example, if your annual revenue is $10 million and your cost of goods sold is $6 million, your gross profit would be $4 million. Using this method, you’d allocate between $400,000 (10%) to $1.2 million (30%) to marketing.

The rationale behind this approach is compelling and grounded in financial reality.

Key Points of the Gross Profit Model:

1. Sustainability Focus: By using gross profit, you’re basing your budget on what’s left after covering the direct costs of your product or service.

2. Scalability: As your gross profit increases, your marketing budget naturally grows with it, creating a flywheel of momentum.

3. Flexibility: The 10-30% range allows for adjustment based on your growth goals and financial situation.

Challenges with the Gross Profit Method:

1. Potential for Underfunding: In highly competitive markets, 10-30% of gross profit might not be enough to drive significant growth.

2. Complexity: Accurately calculating gross profit can be more complex than using top-line revenue.

3. Industry benchmarks often focus on top-line revenue, making direct comparisons difficult. Our calculator below simplifies this by showing the Equivalent Top-Line Revenue Percentage, enabling easier and more accurate comparisons.

My Take: This model grounds your marketing spend in financial reality. It helps prevent the dangerous scenario of “getting over your skis” – growing too fast without the financial stability to support it. I’ve seen too many companies go bankrupt from unsustainable growth strategies.

The Upside: By tying your marketing budget to gross profit, you create a self-regulating system that promotes sustainable growth. As your business becomes more profitable, you can reinvest more in marketing, creating a positive growth cycle.

Bottom Line: Aim to invest at least 10% of your gross profit in marketing to maintain your current position, and push towards 30% for stronger growth. This approach balances ambition with financial prudence, setting you up for sustainable, long-term success.

Gross Profit Method Marketing Budget Calculator

We suggest allocating 10-30% of gross profit to marketing.

$1700000

$357000

17.85%

* Use this equivalent top-line revenue percent to compare with the industry benchmarks provided below.

Benchmarks: Waypoints for Your Marketing Budget

When determining your marketing budget, it’s helpful to have some reference points. These benchmarks can provide context and help validate the budget you’ve calculated using one of the methods we’ve discussed.

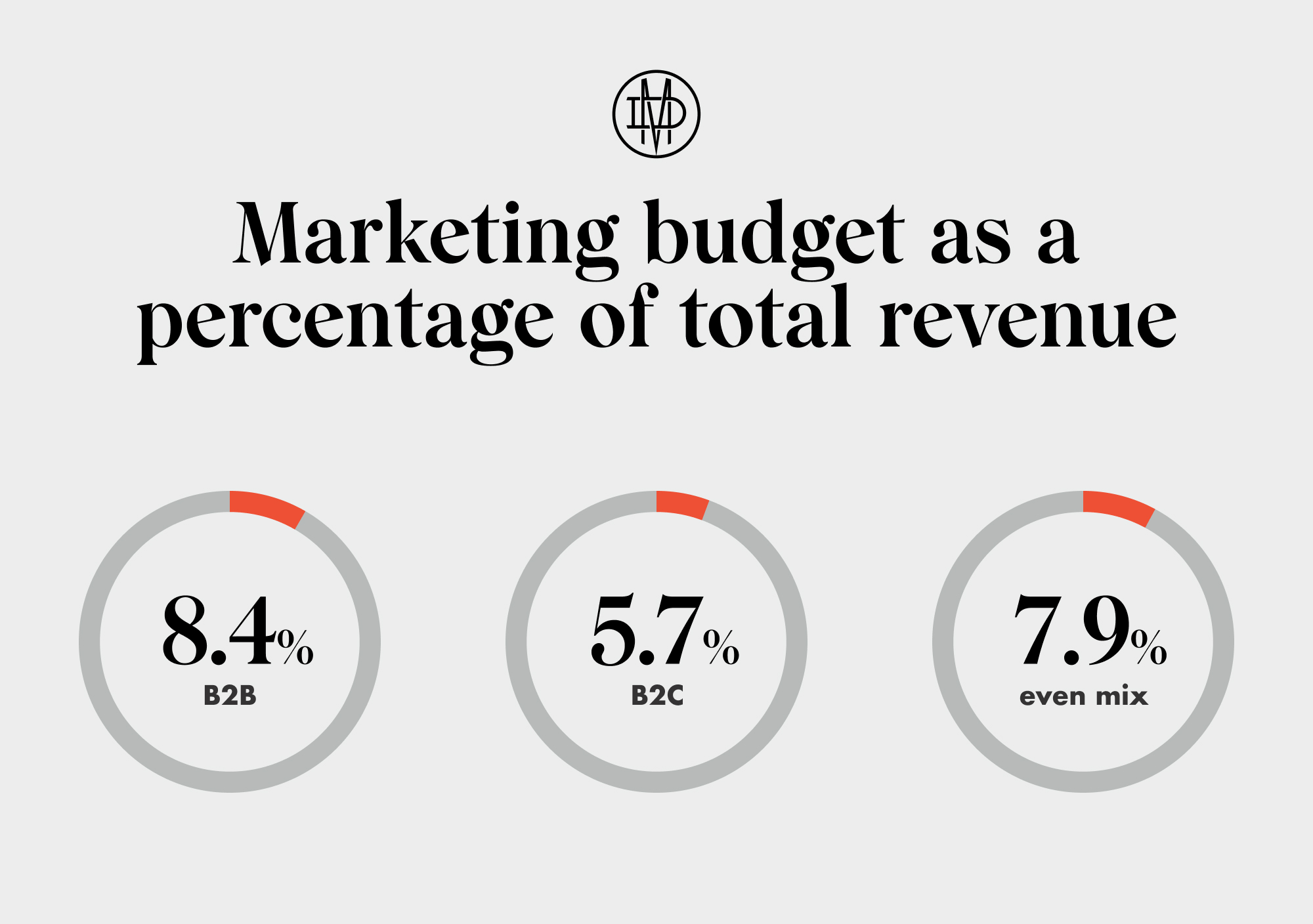

Marketing spending often varies based on whether a company is B2B or B2C. On average, B2B companies spend 8.4% of total revenue on marketing, while B2C companies spend about 5.7%. Companies with mixed models typically fall somewhere in between.

Industry

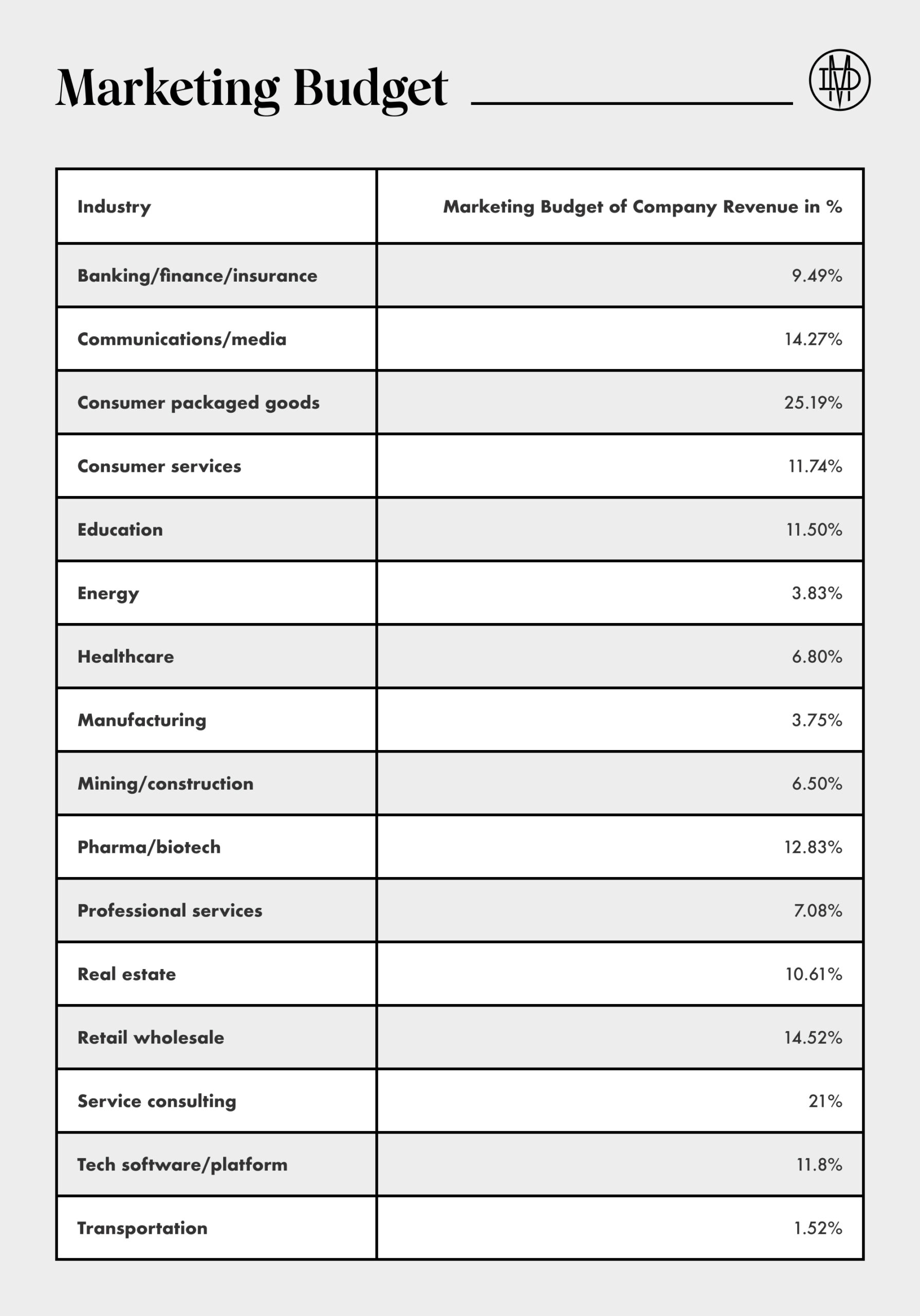

According to The CMO Survey, marketing budgets vary widely by industry. For example, technology companies spend around 21% of revenue on marketing, while manufacturing companies spend only 3.75%. Consumer Packaged Goods leads the pack at 25.19%, while healthcare companies average around 6.80% of revenue.

Growth Stage

The stage of your business can significantly impact your marketing budget. Startups typically have lower marketing spend due to cash flow constraints. Companies in the scaling-up phase often have the highest percentage of marketing spend as they aim for rapid growth. At-scale businesses often reduce their marketing budget, focusing on sustainability and protecting their market share.

Competition

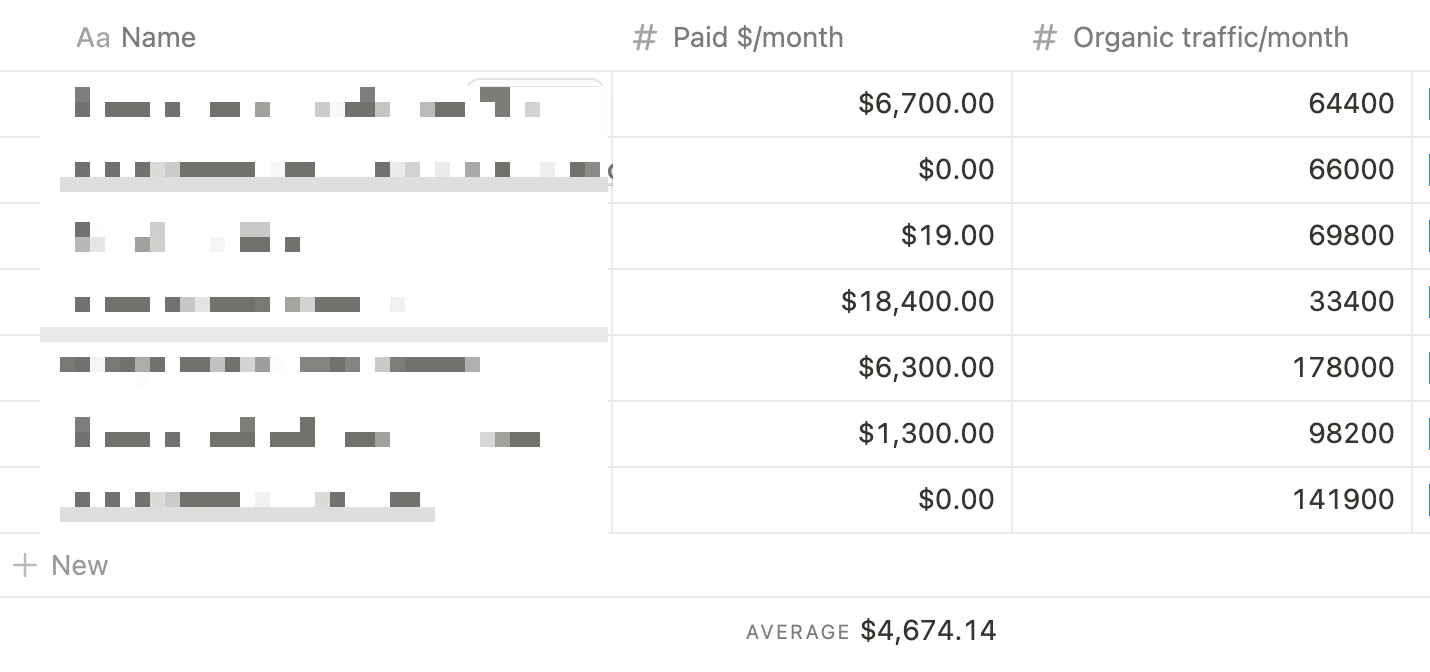

Researching your competitors’ marketing spend can provide valuable insight into what’s necessary to be competitive in your space. Use tools that estimate ad spend or SEO traffic to get a rough idea of what your direct competitors are investing in marketing.

My Take: Benchmarks provide useful context, but don’t let them dictate your strategy. Your specific business needs and goals should always be the primary drivers of your budget decisions.

The Upside: Benchmarks can help you avoid drastically under- or over-spending relative to your industry and competitors. They can also help justify your budget to stakeholders.

Bottom Line: Use benchmarks as guidelines to inform your budget, not as strict rules. Always consider your unique business situation, goals, and financial realities when setting your marketing budget.

Conclusion

Thank you for taking the time to read through this guide on determining your marketing budget. I hope you’ve found it helpful and that you’ve identified the right model for your business, along with relevant benchmark data to inform and strengthen your proposed marketing budget.

As you’ve been reading, I’m sure you’ve been wondering: “Where do I invest this budget, and how do I measure the ROI?” These are crucial questions, and they’ll be the focus of my next posts. The reality is, you can’t effectively explore these topics until you’ve nailed down your budget. Knowing your budget brings clarity to the all-important question of where to actually invest.

If you have any questions about determining your marketing budget or would like to discuss your specific situation, please don’t hesitate to reach out. I’m here to help you navigate this crucial aspect of your business strategy.

Stay tuned for the next post, where we’ll dive into budget allocation and ROI measurement. Until then, happy budgeting!