One lesser-discussed tactic in Amazon's advertising playbook is its discrete use of the Google Ads network. While many are aware of Amazon's internal advertising system, few realize that Amazon also strategically places its ads on Google's vast network. This has the potential to greatly hinder your overall ROAS and profitability.

Amazon Ad Cannibalization: More Than Meets the Eye

It's called "Amazon Ad Cannibalization," and if you're in the e-commerce realm, it's a term you should be deeply familiar with. At its core, this phenomenon is observed when Amazon Ads make an appearance on the Google Search Results page, effectively diverting traffic that might have otherwise funneled through your organic rankings on Google. The result? These visitors are rerouted straight into Amazon's vast marketplace. As if paying for the ads wasn’t enough of a pinch, this diversion comes with a double whammy in the form of Amazon Seller Fees.

It would be misleading to claim that discussions around Amazon Ad cannibalization have just surfaced. In fact, the narrative has been unfolding for some time, especially when focusing on its impact on organic traffic. Dive into the discourse, and you’ll find evidence galore — be it in insights from M19's analysis or the detailed study at Sermondo.

However, while collaborating with one of our clients, we stumbled upon an insight that's nothing short of revelatory.

It's not just your organic traffic that's at stake. **Amazon Ads could be encroaching upon your Google Ads territory as well**, and this covert operation might be inflicting sustained damage to your profitability metrics over time.

1. The Problem

Our client came to us in 2022 for help. Their business was largely self-built with the help of various agencies that specialized in different arenas. Their business was growing, but something startling was happening. Their business in 2022 dropped over $100k a month in revenue from their website. On paper, their combined revenue from all sources was up when including Amazon. Yet, their cost of goods drastically increased due to a few factors. The client was convinced it was due to the performance of their previous paid ads marketing agency.

The client had always ran Amazon Ads in the past and it was never a problem. We asked for a couple of reports to take a closer look.

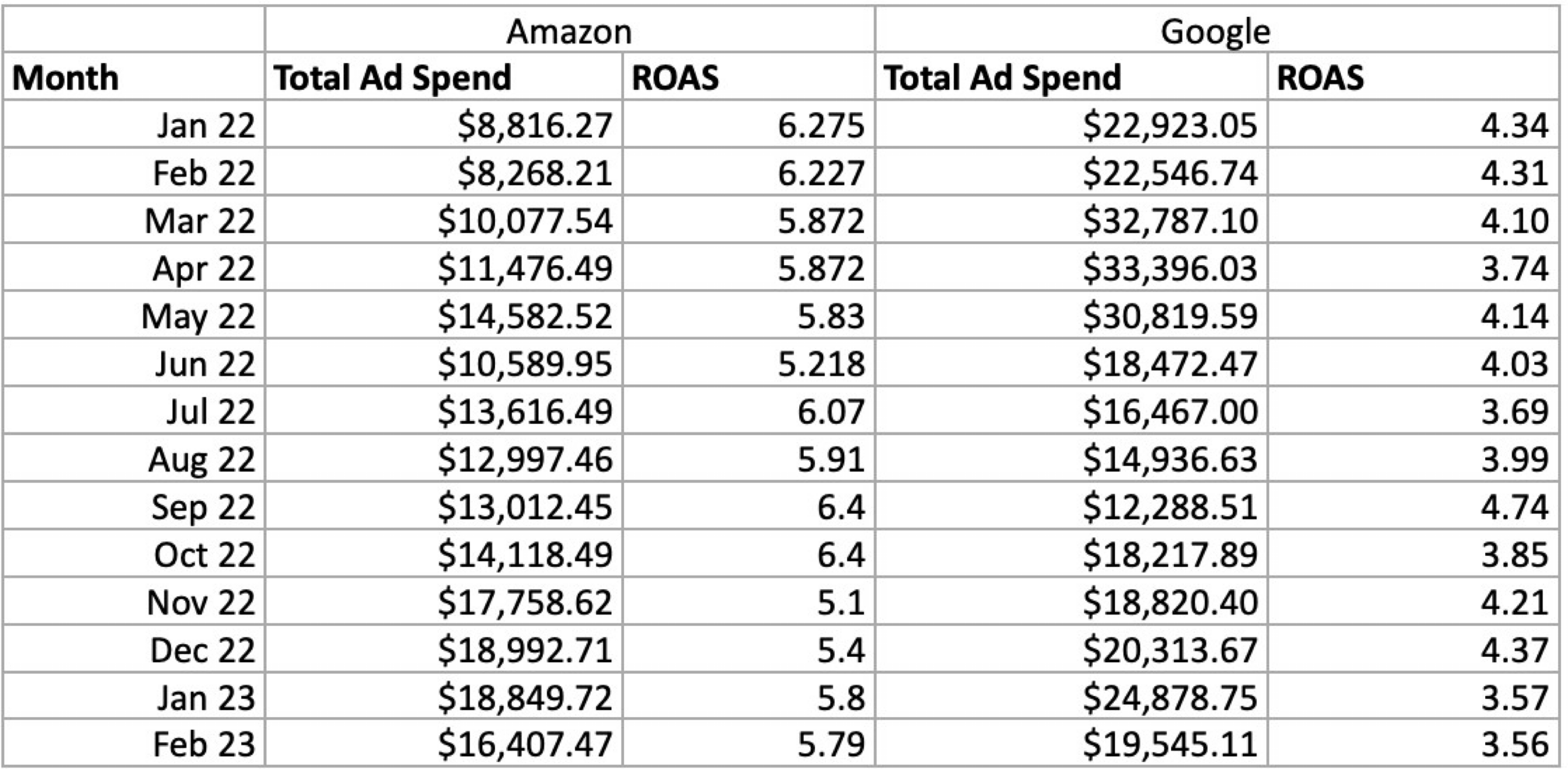

In May of 2022, the client began to scale their Amazon Ad Spend. What ended up happening for the client over the course of the year was going from roughly $8,000 in ad spend $16,000 with little to no dip in their ROAS for their Amazon ads. This is a huge win. Yet at the same time, their Google Ad’s spend steadily declined along with the ROAS.

This information on it’s own is sort of ambiguous and seemingly normal.

And then the smoking gun. Their Universal Analysis Enhanced E-commerce report is shown below.

Their site in a single month lost well over $100,000 in monthly revenue. And what month did this occur? May 2022. The exact same month they began to scale their Amazon Ad spend.

2. What Caused This? The Subtle Tug of the Amazon-Googled Nexus

Amazon has quietly employed a strategy by leveraging the Google Ads network, which is often overlooked in discussions about their advertising tactics.

While many are aware of Amazon's internal advertising system, few realize that Amazon also strategically places its ads on Google's vast network. (See a screenshot of their FAQ policy below)

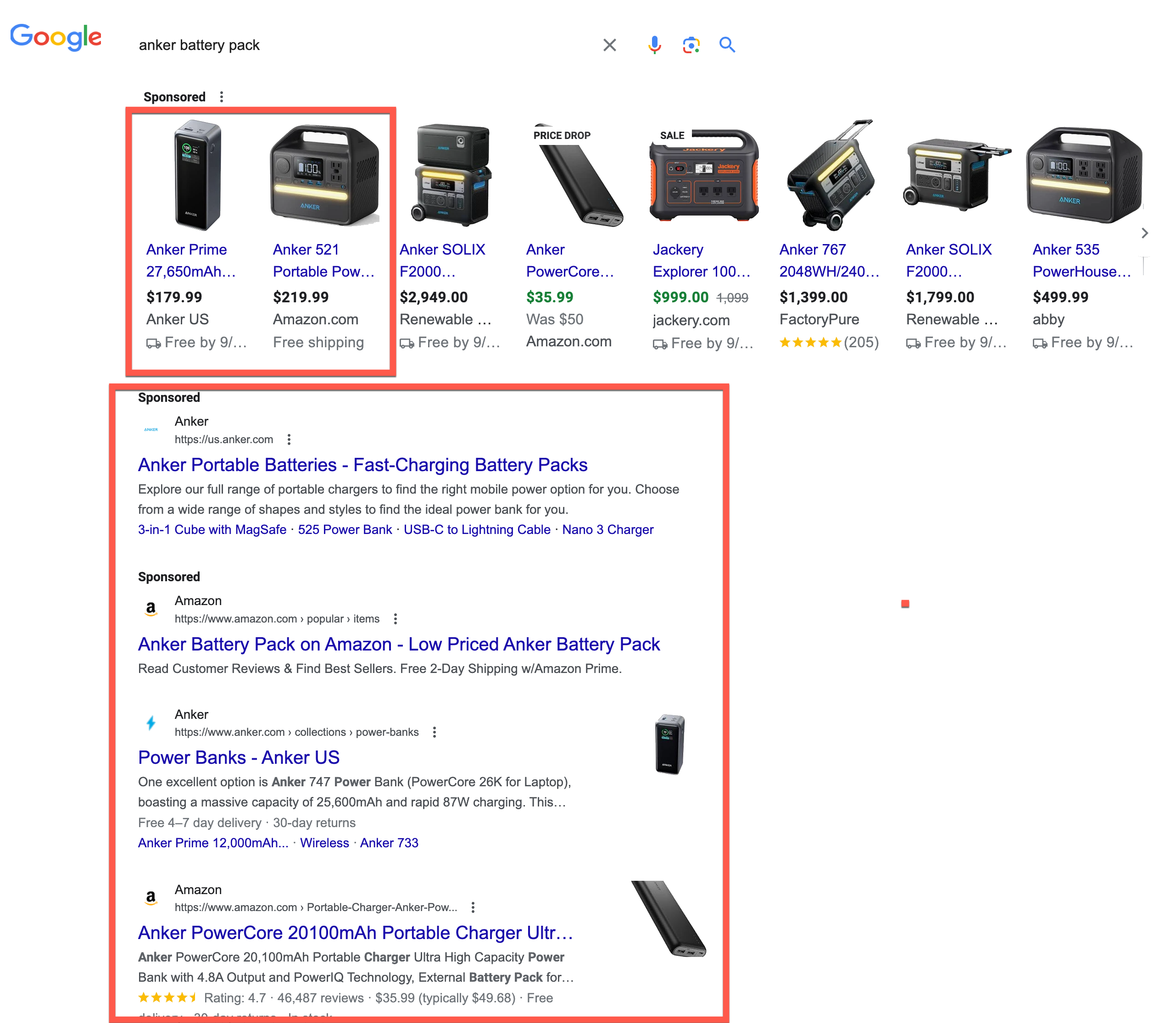

What does this mean for eCommerce business owners? When you're working hard, optimizing your Google Ads campaigns vying for that coveted ad space, you could unknowingly be competing against yourself.

It's a smart play by Amazon to expand their network, but one that warrants caution and strategy on the part of independent eCommerce entrepreneurs. See the examples below of how this brand’s Google Search Ads literally showed up right next to their Amazon listing. You can’t make this stuff up.

Calculating the Real Cost: The Potential Long Term Dangers of This Cannibalization

4. The Hidden Bite of Seller Fees

On top of the advertising expenses, Amazon levies Seller Fees on its platform users, averaging around 15%. While this percentage might seem innocuous, in reality, it's a hefty toll on profit margins. The coping mechanisms? Many brands embed this surcharge directly into the product pricing – a move that does no favors for the discerning consumer. Others, in a bid to remain competitive, reluctantly absorb this cost, impacting their bottom line.

The Data Void: Amazon's Analytical Black Hole

A pivotal concern for technical marketers and CMOs is Amazon's data opacity. Embracing Amazon's cumbersome product page builder comes with a price: a complete blackout on data analytics. You're denied critical insights, as tracking mechanisms like abandoned cart cookies from leading platforms like Klaviyo become inaccessible. Similarly, the tracking cookies vital for powerhouse platforms such as Facebook Ads and Google Ads are rendered defunct.

Brand Erosion: The Silent Casualty

Amidst these tangible financial and analytical challenges lies a more abstract, yet profoundly consequential risk: brand erosion. As customers navigate Amazon and discover a myriad of alternatives, your carefully cultivated brand image faces dilution. An approach that might have initially seemed like a strategic advertising gambit could very well backfire, positioning itself as a fleeting victory, but a long-term threat to sustained profitability.

You are also simultaneously training your customer base to slowly stop searching on Google and just do their searches on Amazon.com.

As a side note, it baffles me still that Google allows this to occur. They are allowing one of the biggest tech giants to train the general public to stop using Google itself. How many times will you click on an Amazon ad before you just go to Amazon and cut out Google as the middle man?

In essence, the allure of Amazon ads, while tempting, must be approached with a critical and well-informed lens.

The potential repercussions extend far beyond immediate costs, encroaching upon brand identity and long-term financial health.

Conclusion:

Am I steering you clear of Amazon ads? Not in the slightest. For a plethora of e-commerce brands, Amazon undoubtedly presents a golden opportunity to bolster revenue streams and profit margins. Yet, every strategic decision is accompanied by pivotal questions that demand introspection:

- Could my website's organic traffic face a downturn?

- Is there a necessity to recalibrate my MAPs (Minimum Advertised Prices) on Amazon to safeguard profitability?

- Before taking the Amazon Ads plunge, are there untapped avenues to amplify traffic to my website? Once you start diverting traffic to Amazon, it becomes difficult to stop.

From one marketing leader to another — a journey through the Amazon ads terrain with both eyes wide open. The road might glitter with potential, but lurking are pitfalls that could undermine the very profitability we diligently work towards.

Here's to enlightened advertising choices and an unwavering commitment to sustained profitability.

- Ryan W. @ Optimal

Ryan Warner

Ryan Warner